Corporation tax is widely and mistakenly seen as a tax on shareholders, which it is not, rather than a tax on investment, which it is. Understanding this issue is vital if we are to have sensible economic policies in the UK and US.

Because UK statistics are so poor, with the necessary long-term data being unavailable, it is necessary to use those of the US to make this clear. We have data for the real returns to shareholders covering the past 217 years and they show that these have averaged 6.4% p.a. and been strongly mean reverting. For the first 115 years there was no corporation tax, as the Supreme Court had ruled that it was unconstitutional and the necessary revision was only passed in 1916 under the threat of war. Since then the effective rate, which through allowances differs from the headline figure, rose to 57% in 1943 and is now down to 13%. For more than half of the period for which we have data there was no corporation tax, and returns to shareholders were the same as those since 1916 when profits were subject to it. In addition there has been no apparent connection between the swings in returns and those in the tax rate.

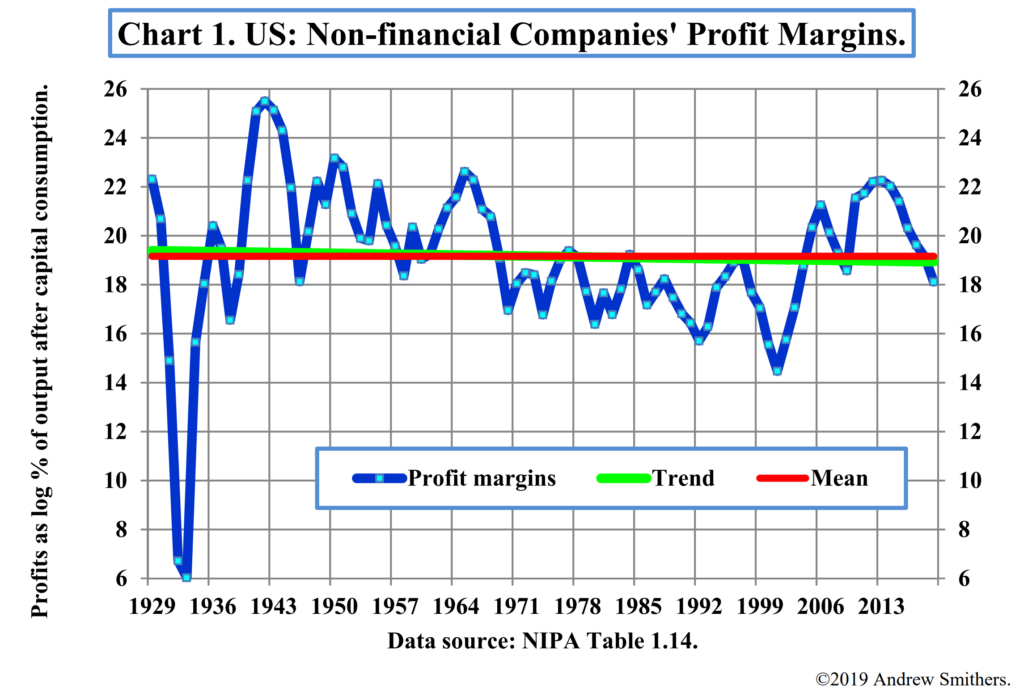

It is clear therefore that shareholders don’t pay the tax, so the question is who does and there are three candidates, workers, consumption and investment. We have data since 1929 on the shares of corporate output going to labour or profit and these, as Chart 1 shows, are also strongly mean reverting. I show the proportion of output going to profits, all the rest goes to pay employees. The near identity of the average with its trend shows that the shares of output going to labour and profits are mean reverting and thus stable over time. Companies cannot therefore be passing the cost of corporation tax either on to labour or consumers, since profit margins and the share of profits are stable.

As neither employees nor shareholders pay corporation tax and the money is raised it must be a tax on something and the answer must be investment. The return on new investment will fall if corporation tax rises unless the return before tax rises and, as the return doesn’t fall, it must rise before tax. At any time the returns on new investment will vary and only those that are expected to give sufficient returns will be made. There will be fewer of these when corporation tax rises and so there will be less investment than there would be if the tax rate had not changed.

Full paper: Corporation Tax